was william devane in the service

Contribution LimitsThe most excellent and apparent similarity between a 401( k) and IRA is the tax benefit. There are many various 401k business for you to invest with, and finding the perfect one is important. When again, it is smart to analyze with a tax expert so that you can prepare your retirement contributions to optimize your tax advantages.

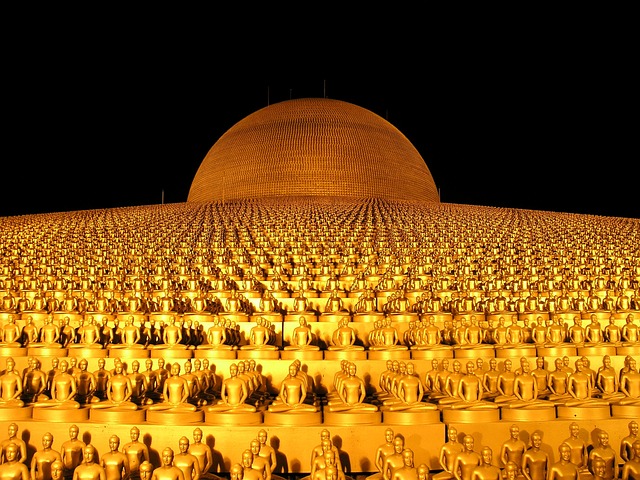

best gold ira investments